Purchasing gold in a gold IRA account – sure, you can do it. But why would you?

How about this for a reason:

In 2001 an ounce of gold cost $271. Ten years later it reached $1,896—do the math that’s an increase of almost 700%. This period was also, by the way, one of the stormiest economic periods of recent history: banks collapsed and currencies quaked. While these calamities devastated other areas of the market, gold thrived.

As harsh winds blew from subprime mortgages, credit default swaps and other derivatives that even experts don’t understand, gold shined through it all. Search “gold” on Google and you’ll find plenty of talk about gold’s reputation as the standard of wealth, the original money, and a safe haven from economic turmoil. Gold has been as store of wealth of kings and empires for thousands of years. Gold and silver will protect your purchasing power – unlike money, gold and silver can’t be printed or debased. It is nature’s true hard asset.

If you’re looking for security and stability in your retirement portfolio then the answer is Yes.

In a self-directed gold IRA, Roth IRA, or 401(k) you can buy gold or silver coins or bullion.

Retirement plans typically offer traditional IRAs or 401(k)s that hold stocks, mutual funds, annuities or other assets. Most often, investors have little or no say in the investments being made. With a self-directed plan, the holder is empowered to make his or her own investment decisions, and if they so choose, to add to the available investment options. Precious metals can be among those options.

The investor begins by transferring their traditional IRA. Current law allows for both transfers of IRAs as well as rollovers from other qualified retirement plans.

Investing in gold or silver in an IRA can be as simple as rolling over your account as you would for any paper investments. The transaction is fast and its characteristics make precious metals a perfect investment. In fact, the use of a Self-Directed gold IRA purchase is one of the most tax efficient ways to finance your Gold/Silver purchase.

We’ve talked about the virtues of gold – what about silver?

We’ve talked about the virtues of gold – what about silver?

Silver is used in a growing number of industrial applications that are only going to increase with the development of newer technologies: smart phones, tablets, televisions, and solar cells all have a high demand for the use of silver.

More so than even gold, quantities of available silver are limited and unless you believe that demand for high tech is on the wane, there can only be one way for silver prices to go.

From 2008 to 2010, silver enjoyed an upwards trend of $16 per troy ounce and skyrocketed to a $48.70 peak – an increase of over 300%! Historical records over the past 15 years show that silver has always held a reasonably strong position in the market because traders know precious metals are a safe haven because some of them can be used as legal tender.

Bullion is easily stored and transported, as you can stack bars which were produced by the same mint. Bullion also carries the lowest premium over spot price for both gold and silver. On the other hand, unlike coins, generic bars produced by normal mints do not offer any sort of “collectability” factor. Also, the largest bars (10 oz gold bars or 100 oz silver bars) may be harder to trade in event of a crisis than smaller bars.

For their part, coins offer a collectability factor that bars and rounds do not provide. In a pinch, coins – such as Silver Eagles or American Gold Buffalos – can also be considered legal tender (although it’d be foolish to spend coins as legal tender as they’re worth much more as metal).

Again, your choice depends on your individual financial objectives and circumstances.

Begin Protecting Your Wealth Today

Begin Protecting Your Wealth TodayTo learn much more about investing in gold and silver and how these precious metals can help you grow your wealth even in the most uncertain economic times, download our FREE “Gold and Silver Investment Guide”

This powerful course could save you thousands of dollars and is filled with tips and expert advice you need to make the best possible decisions for you.

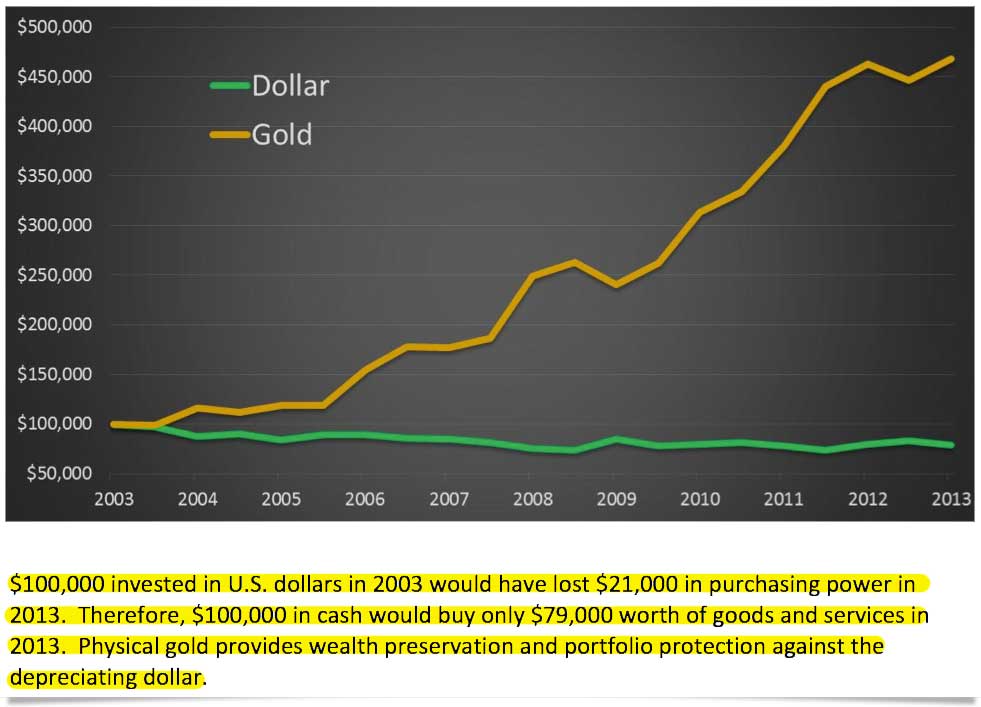

With today’s economic uncertainty, adding gold or silver to your portfolio could be your best diversification strategy – serving as a potential hedge against inflation and a declining dollar.

Protect yourself today.

RC Bullion, LLC, 1230 Rosecrans Ave, Ste 300, Manhattan Beach, CA 90266

Risk Disclosures: Purchasing Precious Metals For Physical Delivery in bullion, bars, coins, proof coins, numismatic coins involve a degree of risk that should be carefully evaluated prior to investing any funds. RC Bullion LLC and its agents are not registered or licensed by any government agencies and are not financial advisors or tax advisors. Past performance is not an indicative of future results. Investors should do their due diligence before committing any money to purchase gold and other precious metals. If you have additional questions, please contact RC Bullion.