Since the IRS changed the tax code in 1998 many investors have wondered whether it is better to buy gold coins or bars with their retirement funds.

This is a question we will answer shortly. But first let’s take a quick look at just why gold is such a good investment opportunity today.

The main reason why gold is such an attractive investment today is that throughout history it has held its value while other forms of currency and investment have shown extreme volatility.

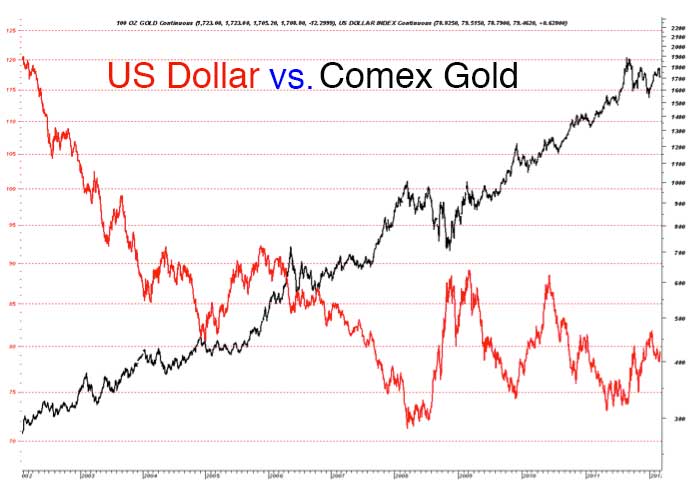

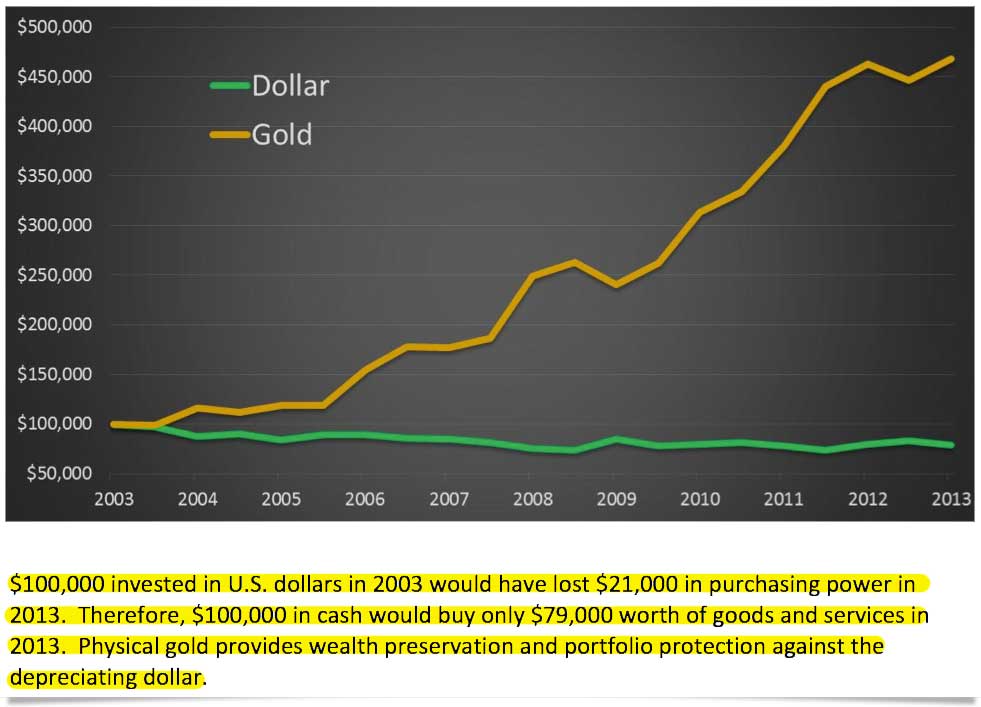

For example, the U.S. dollar has lost value for 40 years and now has just 20% of the purchasing power it had in the 1970s.

As additional examples, the real estate market is down, stock and currency investing is turbulent and experts are saying that we can no longer rely on Social Security or the government to take care of us when we retire.

But while all of this has been going on, physical gold prices have trended upward for the past 10 years and experts expect them to continue rising – in fact, many experts now believe gold could reach as much as $5,000 or even $10,000 an ounce at some point.

Legendary trader Jim Sinclair recently said that there may not be a better time than right now to invest in gold at least through 2017.

Sinclair, who has been actively trading the markets for over 50 years, recently said in an interview with King World News that “We already set the low in gold. We are now on our way to $3,500. The opinions that gold and silver are going significantly lower are not correct. There have never been more signs of a bottom in a market than you see presently.”

Another reason gold is such a good investment opportunity is that the value of physical gold has also remained steady over time – for example, gold 100 years ago would have bought the same amount of goods as gold today … this makes gold a good safe haven against inflation and financial crises.

The truth is since the US went off the Gold Standard in 1971, gold has consistently outperformed stock market, real estate and currency investing.

And since possession of physical gold doesn’t require management fees it’s an even more attractive investment option for most people.

In fact, many experts would argue that the only way to achieve true diversification in your portfolio today is to invest, at least 10% to 30% of your funds, in gold.

1. Liquidity – gold can be readily converted into cash or goods when needed as it is recognized as a valuable currently worldwide.

2. Tax Deferred Growth – investing in gold allows you to accumulate growth on a tax-deferred basis.

3. Consistent purchase power – gold’s value, and as a result, its purchasing power, has remained steady for hundreds of years.

One big difference between bars and coins is that on a buyback coins typically offer a few dollars over melt value, or market value.

One big difference between bars and coins is that on a buyback coins typically offer a few dollars over melt value, or market value.

On the other hand, with bars you get a straight spot on a buyback.

That’s why most experts will recommend that you purchase coins instead of bars.

Coins are generally seen as a more profitable venture.

Also, if you were looking to liquidate in many instances with large bars you will not be able to liquidate part of the bar, you will have to liquidate the entire bar at once.

That’s why when it comes to liquidation it also makes sense to have coins in your possession instead of bars.

To learn much more about the differences between coins and bars or to invest in precious metals and start growing your retirement savings, please contact RC Bullion at 213-465-4835

RC Bullion, LLC, 1230 Rosecrans Ave, Ste 300, Manhattan Beach, CA 90266

Risk Disclosures: Purchasing Precious Metals For Physical Delivery in bullion, bars, coins, proof coins, numismatic coins involve a degree of risk that should be carefully evaluated prior to investing any funds. RC Bullion LLC and its agents are not registered or licensed by any government agencies and are not financial advisors or tax advisors. Past performance is not an indicative of future results. Investors should do their due diligence before committing any money to purchase gold and other precious metals. If you have additional questions, please contact RC Bullion.