At a time when the value of the dollar is declining, the real estate market is down, and stock and currency investing is turbulent, many investors are turning to gold … and with good reason as it turns out.

For instance, gold prices have trended upward for the past 10 years and experts expect them to continue rising.

Plus, the value of gold has also remained steady over time – for example, gold 100 years ago would have bought the same amount of goods as gold today.

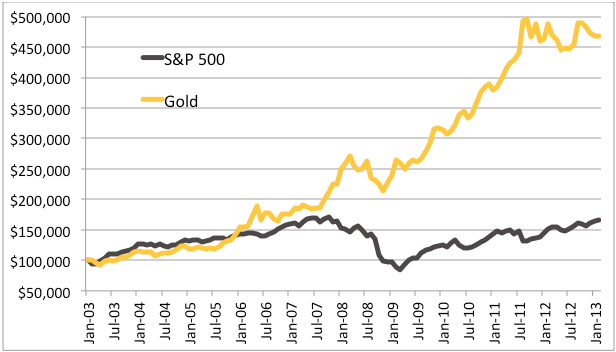

Here’s another fact, in the last 10 years the gold market has outperformed the stock market by a 4 to 1 ratio. It’s true, plus gold also comes with a number of tangible benefits over investing in paper stocks.

1. You get to maintain physical possession of your gold coins

2. You get to avoid all those costly brokerage fees that commonly accompany stock investments

3. You diversify yourself against the risks of investing solely in stocks, bonds and mutual funds

Here’s one more reason why more people are investing in gold, it’s much easier to do today.

In fact, many businesses today, like RC Bullion, are willing to guide investors step by step through the entire process.

Only you can decide for sure but many analysts seem to think so.

Legendary trader Jim Sinclair says that there may not be a better time than right now to invest in gold at least through 2017.

Sinclair, who has been actively trading the markets for over 50 years, recently said in an interview with King World News that

Sinclair, who has been actively trading the markets for over 50 years, recently said in an interview with King World News that

“We already set the low in gold. We are now on our way to $3,500. The opinions that gold and silver are going significantly lower are not correct. There have never been more signs of a bottom in a market than you see presently.”

Sinclair went on to say during that same interview that “There has never been a time where there has been such a degree of bearishness, and the greatest bearishness being into the gold shares themselves.

Looking back in history, this must be the greatest opportunity that exists in this market between now and 2015 to 2017.”

Earlier this year, Sinclair went one step further when he released a subscriber alert in which he said “gold will trade to $4,990 in a coming bull run prior to settling into a role as currency for the beginning of the greatest economic expansion in history.”

And while gold is getting all the good news many are preparing for a new round of bad news from the stock market …

Right now in 2013, we have the stock market at an all time high at over 15,000 while gold and silver at year and a half lows, which means this is a tremendous opportunity to transition out of one asset at a high into another asset at a low.

In fact, many experts are comparing the conditions today back to the conditions in 2009 when the stock market was at a high of 14,000 points. At that time, many people held onto their stocks and six months later the stock market went from 14,000 to 6,700 with many people losing over half of their retirement accounts.

It happened five years ago, it could happen again – as we all know history tends to repeat itself.

Meanwhile history has repeatedly shown that unlike “paper” investments, gold isn’t symbolic of wealth.

Gold is wealth.

Most experts now see gold as the antidote for inflation and interest rates.

To learn more about protecting – and growing – your retirement savings by investing in gold precious metals, contact RC Bullion at 213-465-4835

RC Bullion, LLC, 1230 Rosecrans Ave, Ste 300, Manhattan Beach, CA 90266

Risk Disclosures: Purchasing Precious Metals For Physical Delivery in bullion, bars, coins, proof coins, numismatic coins involve a degree of risk that should be carefully evaluated prior to investing any funds. RC Bullion LLC and its agents are not registered or licensed by any government agencies and are not financial advisors or tax advisors. Past performance is not an indicative of future results. Investors should do their due diligence before committing any money to purchase gold and other precious metals. If you have additional questions, please contact RC Bullion.