What is a gold IRA Account? A self-directed gold IRA account allows you to store your assets in gold, silver, or other precious metals rather than paper investments. The gold can be in the form of gold bullion or coins. When your retirement is at stake, you want the best protection your money can buy. Gold is your ultimate hedge against market volatility and unpredictability. While traditional IRAs are dependent on a select group of paper investments inextricably linked to the economy, a gold IRA holds an actual tangible asset. .

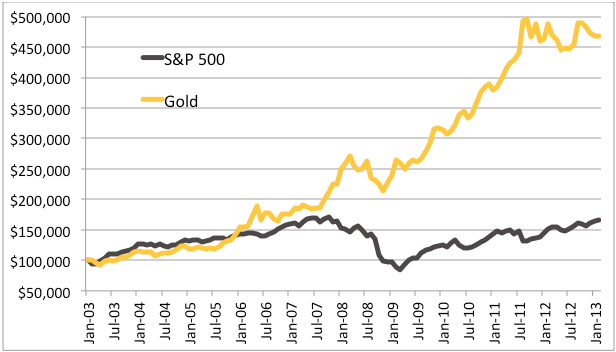

With a traditional IRA, as the stock market plunges so does the value of your IRA. Over the last 10 years gold has outperformed the Dow by over 400%. Gold’s value has historically moved counter to the direction of stocks, bonds, and mutual funds as the market corrects and investors look for more secure places for their money. With that kind of performance record, shouldn’t you consider securing your lifetime of savings and putting a portion of your retirement into the intrinsic value of physical gold?

Gold’s history as a safe haven for wealth protection reaches back thousands of years. This is due to the fact that gold is a tangible and finite resource and not subject to the kinds of dilution that makes paper investments so vulnerable.

In a self-directed gold-backed IRA account, your gold will be protected from the unpredictability and risks brought on by governments or financial institutions.

As gold can’t be printed at will like money, it isn’t subject to devaluation, nor will you ever have to worry about the mergers or the splits of stocks. By choosing to invest in gold bullion or coins you’re protecting your wealth against future financial turmoil.

IRAs – Individual Retirement Accounts – come with a number of tax advantages. Different types of IRAs have different benefits and rules as to how much can be withdrawn. Making the right choice for you will depend on your particular financial objectives. With traditional IRAs your contributions can be tax deductible – depending on income – and won’t be subject to tax until they’re distributed within certain conditions. With a Roth IRA, you make after-tax contributions with the potential for tax-free income in retirement – again, with certain conditions. A Roth can be used in conjunction with your 401(k).

You have the option to purchase the gold which will be stored in a fully insured depository, operated and insured by the government (the gold is shipped to you once you reach the age of retirement), or you can hold the physical gold yourself by having it delivered to your door. While purchasing physical gold may seem complicated, this is not the case.

You have the option to purchase the gold which will be stored in a fully insured depository, operated and insured by the government (the gold is shipped to you once you reach the age of retirement), or you can hold the physical gold yourself by having it delivered to your door. While purchasing physical gold may seem complicated, this is not the case.

The acquiring of your gold for your IRA can be a simple transaction. It just requires you to include gold as part of your investment portfolio and choose the right custodian or broker to make the transactions for you.

Most people know that a gold IRA investment is a good idea but most have no idea how to get started. Let us help you invest like a pro with our free download “The Secret to Successful Gold Investing.” Learn how to buy gold in an IRA account, convert your IRA into a gold-backed IRA, or whether choosing bullion or gold coins in an IRA account is best for you. Give your hard-earned wealth the best protection possible today!

RC Bullion, LLC, 1230 Rosecrans Ave, Ste 300, Manhattan Beach, CA 90266

Risk Disclosures: Purchasing Precious Metals For Physical Delivery in bullion, bars, coins, proof coins, numismatic coins involve a degree of risk that should be carefully evaluated prior to investing any funds. RC Bullion LLC and its agents are not registered or licensed by any government agencies and are not financial advisors or tax advisors. Past performance is not an indicative of future results. Investors should do their due diligence before committing any money to purchase gold and other precious metals. If you have additional questions, please contact RC Bullion.